Share this infographic

2022 CBN Financial Statements

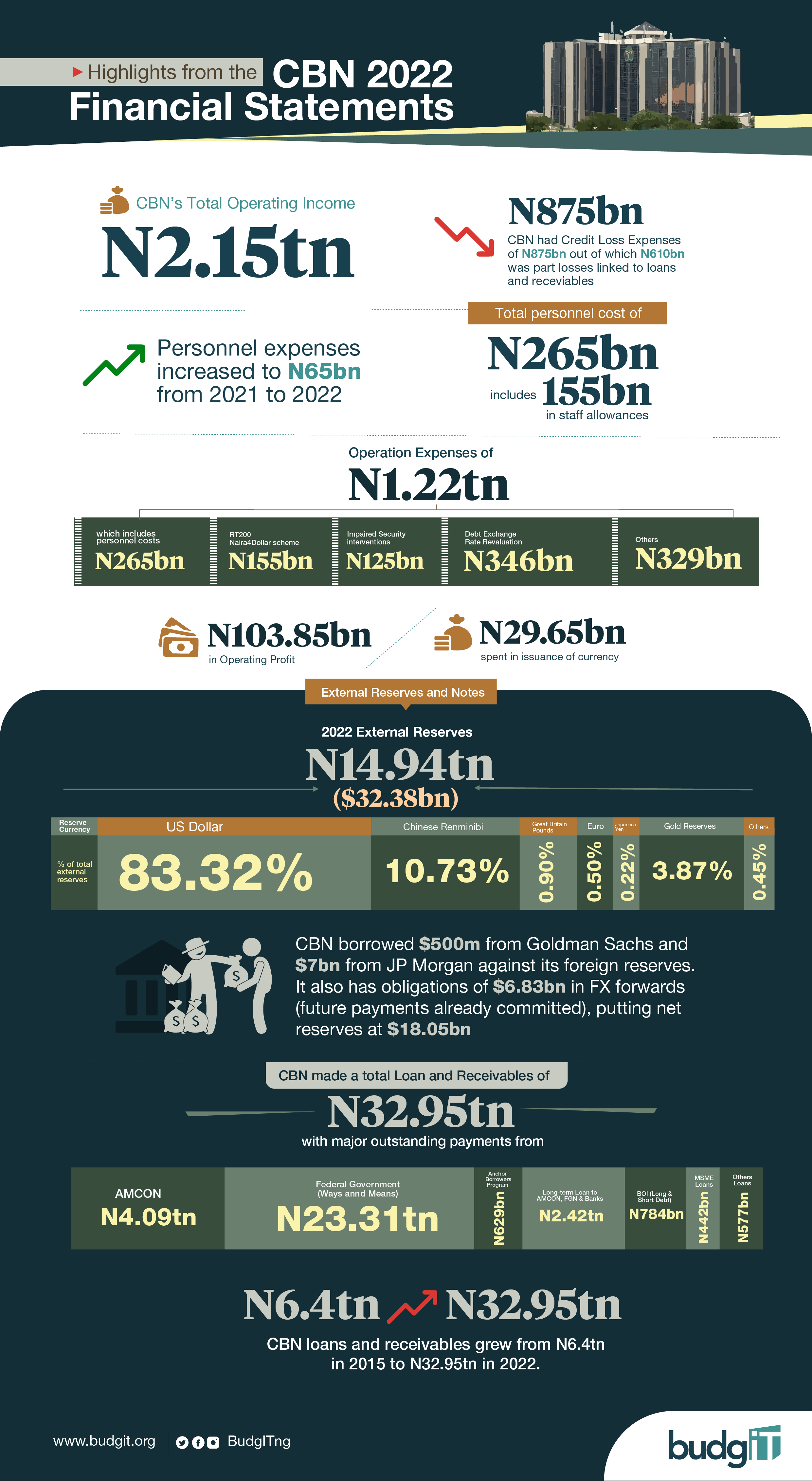

For 2022, CBN total operating income stood at N2.15tn. CBN had credit loss expenses of N875bn, of which N610bn was part losses linked to loans and receivables.

Personnel expenses increased to N65bn in 2022. Total Personnel cost of N265bn includes N155bn in staff allowances

Operation expenses of N1.22tn, includes personnel costs of N265bn, RT200 Naira4Dollar scheme of N155bn, impaired security interventions of N125bn, debt exchange rate revaluation N346bn, N103.85bn in Operating Profit, N29.65bn spent in issuance of currency.

2022 external reserves stand at N14.94tn ($32.38bn), of which the US Dollar component has the highest at 83.32%, Chinese Renminbi 10.73%, Great Britain Pounds 0.90%, Euro 0.50%, Japanese Yen 0.22%, Gold Reserves 3.87%, and 0.45% for other components.

CBN borrowed $500m from Goldman Sachs and $7bn from JP Morgan against its foreign reserves. It also has obligations of $6.83bn in FX forwards (future payments already committed), putting net reserves at $18.05bn.

CBN loans and receivables grew from N6.4tn in 2015 to N32.95tn in 2022, with major outstanding payments from AMCON, Federal Govt (ways and means), Anchor Borrowers Program, Long-term Loan to AMCON, FGN & Banks, BOI (Long & Short Debt), MSME Loans & Others Loans

Explore Related Tags

The BudgIT “Infographics”, made available under the Creative Commons License CC BY-ND 3.0, may be used and displayed without charge by all commercial and non-commercial websites. Use is, however, only permitted with proper attribution to Budgit. When publishing one of these graphics, please include a backlink to the respective infographic URL.

Explore infographics from Other Countries