Press Statement

BudgIT, a foremost civic-tech organisation leading the advocacy for fiscal transparency and accountability in Nigeria, has launched the 2022 edition of its annual States of States report titled; Sustainable Governance Reforms for a New Era. This report, which is BudgIT’s signature analysis, assesses and ranks the fiscal performance of all 36 states, from the most sustainable to the least sustainable.

For the 2022 edition, all 36 states were ranked using 5 metrics. Index A examines states’ ability to meet Operating Expenses (Recurrent Expenditure) with only their Internally Generated Revenue.; Index A1 looks at the percentage year-on- year growth of each state’s Internally Generated Revenue. Index B reviews states’ ability to cover all operating expenses and loan repayment obligations with their Total Revenue (Internally Generated Revenue + Statutory Transfers + Aids and Grants) without resorting to borrowing. Index C estimates the debt sustainability of the states using 4 major Indicators. D. Personnel Cost as a % of Revenue. Index D evaluates the degree to which each State is prioritising capital expenditure with respect to their operating expenses (recurrent expenditure).

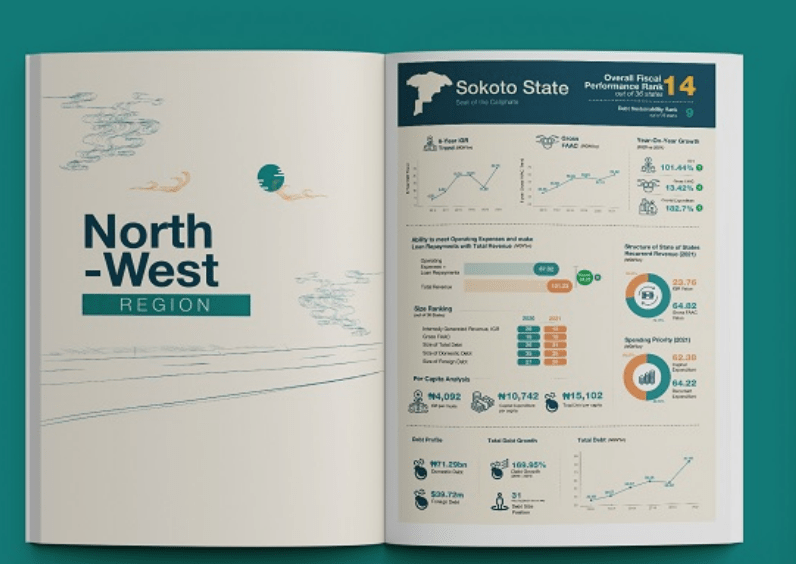

Rivers state maintained its overall fiscal performance position, ranking 1st, just like it did in 2020 and 2021. While two states, Kaduna and Cross River made it to the top 5 on the overall fiscal performance ranking, Yobe State dropped to the bottom 5 having fallen 13 places from 21st in 2021 to 34th position in 2022. On Index A, just 2 States (Lagos and Rivers) generated enough revenues internally to take care of their operating expenses.

Comparatively, the operating expenses of Yobe and Bayelsa (the least ranked states on index A) was more than 7 times the revenues generated by both States Internally, reinforcing the heavy reliance on federal transfers and budget support to fund their budgets. On index A1, save for 3 states which ranked the least—Anambra, Kogi and Kebbi—33 states experienced an increase in their IGR from the previous year, with 13 states growing their IGR by more than 50%. Jigawa, Delta, Ebonyi, Akwa Ibom and Nasarawa ranked 1st – 5th respectively on Index C which assessed the debt sustainability of the 36 states.

Furthermore, Cross River, Ogun, Imo, Osun, Plateau were the bottom 5 states on Index C. Lagos State, with a capital importation of $31.78bn between 2019 and 2021, received 99.19% of the cumulative capital importation for 36 states of the federation. Interestingly, 11 states received no capital importation between 2019 and 2021.

Speaking of debt sustainability, the cumulative debt stock of the 36 States grew by 8.68% from N5.86tn in 2020 to N6.37tn in 2021. A more disaggregated view of the subnational debt shows that 11 states reduced their total debt liability, with Delta State having the most impressive decline of 33.84%.

Four states—Oyo, Yobe, Ogun and Sokoto—grew their total debt stock by more than 40% from 2020. The 5 most indebted states—Lagos, Kaduna, Rivers, Ogun, and Cross River—are responsible for 37.09% of total subnational debt. Kogi State, with a foreign debt year-on-year growth of 85.65%, ranked 1st among the 17 States that grew foreign debt in 2021. The four states with the highest dollar-denominated debt ($250mn and above)—Lagos, Kaduna, Cross River and Edo—are the most susceptible to exchange rate volatility.

The cumulative expenditure of the 36 states increased by 27% from N5.23tn in 2020 to N6.64tn in 2021. Notwithstanding, while 31 States increased their total expenditure from the previous year, 5 States reduced their expenditure—with Zamfara having the highest decline of 15.59%.

However, the cumulative personnel cost of the 36 States grew by 5.38% from N1.46tn in 2020 to N1.54tn in 2021. Interestingly, 9 States reduced their overhead cost from the previous year, signalling a reduction in the cost of governance. Conversely, 11 States increased their overhead cost from the previous year by more than 40%, with Akwa Ibom having the highest growth.

Commendably, cumulative spending on capital expenditure by the 36 States grew by 52.52% from N1.77tn in 2020 to N2.70tn in 2021. 8 States increased the capital expenditure year-on-year by more than 100%, however, just 5 States—including Anambra, Ebonyi, Cross River, Kaduna, Rivers — prioritised capital expenditure over operation expenses, signalling the prioritisation of investments in infrastructure, job creation, and human capital development.

“On fiscal transparency, the 36 states of the federation currently publish in a timely manner their proposed budgets, approved budgets, budget implementation reports, audited financial statements for both the States and the Local Governments. In the same vein, many states have enacted an Audit Law that grants operational and financial autonomy to the Offices of Auditors-General of the State and Local Governments, thereby empowering their supreme audit institutions to effectively hold governments accountable.”, said Iniobong Usen, BudgIT’s Research and Policy Advisory Lead.

35 States, excluding Taraba, have captured the biometric and BVN data of at least 70% of the civil servants and pensioners on their payroll, and linked the captured data to their payroll management system. Cumulatively, 35 states (excluding Taraba), have a total of 848,483 civil servants and 498,097 pensioners on their payroll. As result, at least 15,397 ghost workers have been identified and eliminated in 13 states across the federation.

On the flip side, only a few states have been able to establish and operationalise a state-level functional Treasury Single Account (TSA) to ensure that it covers at least 70% of all its finance. Similarly, a number of States are yet to ensure that all the schedules of contracts awarded for the year are published online as required under the Open Contracting Data Standards and in line with the procurement laws/guidelines.

You can check key insights from the report here: https://stateofstatesreport.yourbudgit.com/

Download the Full report here: https://bit.ly/2022StateofStates.